State Farm Insurance Wrongfully Denies

Underinsured Motorist Claims of Government Employees

State Farm Insurance Wrongfully Denies Underinsured Motorist Claims of Government Employees

Most State Farm automobile insurance policies carry Underinsured motorist and uninsured motorist insurance coverage (UM/UIM). Underinsured motorist coverage protects policyholders when the at-fault party causing your accident lacks coverage or carries insufficient coverage to pay the full value of your claim. UIM coverage provides additional coverage when the insurance limits of the defendant are not adequate to cover your damages. Uninsured motorist coverage protects policyholders when the at-fault driver in the accident has no insurance at all.

For example: if the at-fault driver has only a minimum limits of thirty thousand dollars ($30,000.00) in liability coverage, and you have a UM/UIM policy of one hundred thousand dollars ($100,0000.00), you may be able to recover thirty twenty five thousand dollars ($30,000.00) from the at-fault party, and as much as eighty thousand dollars ($70,000.00) from your own UIM policy to equal the maximum limit of one hundred thousand dollars ($100,000.00), if your injuries warrant such a recovery. Uninsured motorist coverage protects policyholders when the at-fault driver in the accident has no insurance at all.

State Farm Denies UM/UIM Claims of Government Employed Customers who are Injured While Driving for Work if Reciving Workers Compensation Benefits

State Farm takes the position that it does not owe its customers any UIM Auto Insurance Coverage benefits when the customer is injured while driving for work if the government employer’s workers compensation pays any medical expenses. State Farm’s position is that because the government’s workers comp program may have a right of subrogation (reimbursement of the expenses paid) against the employee’s UIM coverage benefits, State Farm would just be paying the government if any money is paid to its customer. This position is simply wrong.

State Farm’s Reason for Denial of UIM Benefits to Its Own Customers who are Government Employees is False

State Farm’s claim that paying UIM benefits to its customers who are government employes would just be paying the government is simply insurance bad faith. For example, if a State Farm customer who works for any Federal government entity is injured on the job, they are entitled to workers compensation benefits through the Office of Workers Compensation Program ("OWCP"). The OWCP does not and will not make any subrogation claim against any government employee’s UIM policy and its says so in the OWCP Third Party Liability Manual.

Wrongfully Denying UIM Claims to Government Employees is Insurance Bad Faith by State Farm

So, when a customer pays money to State Farm for coverage under their own personal policy in case some other driver with inadequate insurance causes them injuries, when that customer who is paying for the coverage is a government employee, the coverage doesn’t exist. Due to State Farm’s decision to deny all UIM claims where a government (or what they call a “government opened business”) may have a subrogation lien, that State Farm insurance customer is paying their insurance company for nothing. This occurs despite the fact that State Farm’s position is completely false. Government self-insured plans like the Federal Employee OWECP workers comp plan do not subrogation against and employee’s personal UIM benefits and have no intention of making a claim for any funds State Farm owes its customer under their personal automobile insurance policy.

State Farm Fights to Avoid Paying UIM Claims

If you are insured with State Farm, you have a policy with the largest auto insurance company in the country. Founded in 1922, it has 19,000 agents and 83 million car, fire, life, and health policies across the United States and Canada. With the largest market share, State farm has the resources and experience to fight thy company’s own customers when faced with a claim.

UIM claims can be tricky, especially with State Farm. Once you seek to have State Farm pay your UIM claim, you might be surprised when you are treated like an adversary rather than a State Farm customer.

State Farm claims are a battle. This insurer will fight to pay out as little for your claim as possible. But you can win your insurance claim against State Farm if you know your rights. If you’ve been injured in a car accident, the stress and aggravation and time required in dealing with injuries, rehabilitation, lost time at work and other crash-related expenses, can be made much worse when your own insurance company works against you.

Experienced State Farm UIM Bad Faith Attorney

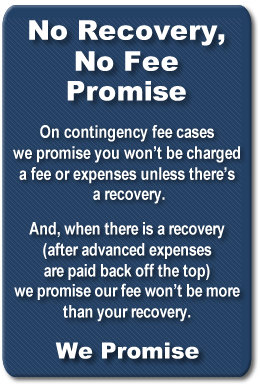

The lawyers at Hemmings & Stevens, PLLC have experience with State Farm’s bad faith insurance practices. If State Farm or any other insurance company denies your claim for UM/UIM benefits, we can help. We may choose to file a lawsuit seeking damages for insurance bad faith. You can call our office today at 919.277.0161 or email us to schedule your free case evaluation.